njtaxation.org property tax relief homestead benefit

Agedisability status whether you. For most homeowners the benefit is distributed to your municipality in the form of a credit which.

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

Unsure Of The Value Of Your Property.

. Find All The Record Information You Need Here. Eligible seniors or disabled people with New Jersey gross income of up to 100000 would get a credit worth 5 of their 2006 property taxes. Homestead Deduction and Senior Citizen or Disabled Property Owner Tax Relief.

Dont Miss Your Chance. 150000 for homeowners 65 or older or blind or disabled. Senior and disabled homeowners with income below 150000 average receive 534 benefits and other eligible homeowners with less than 75000 receive an average of.

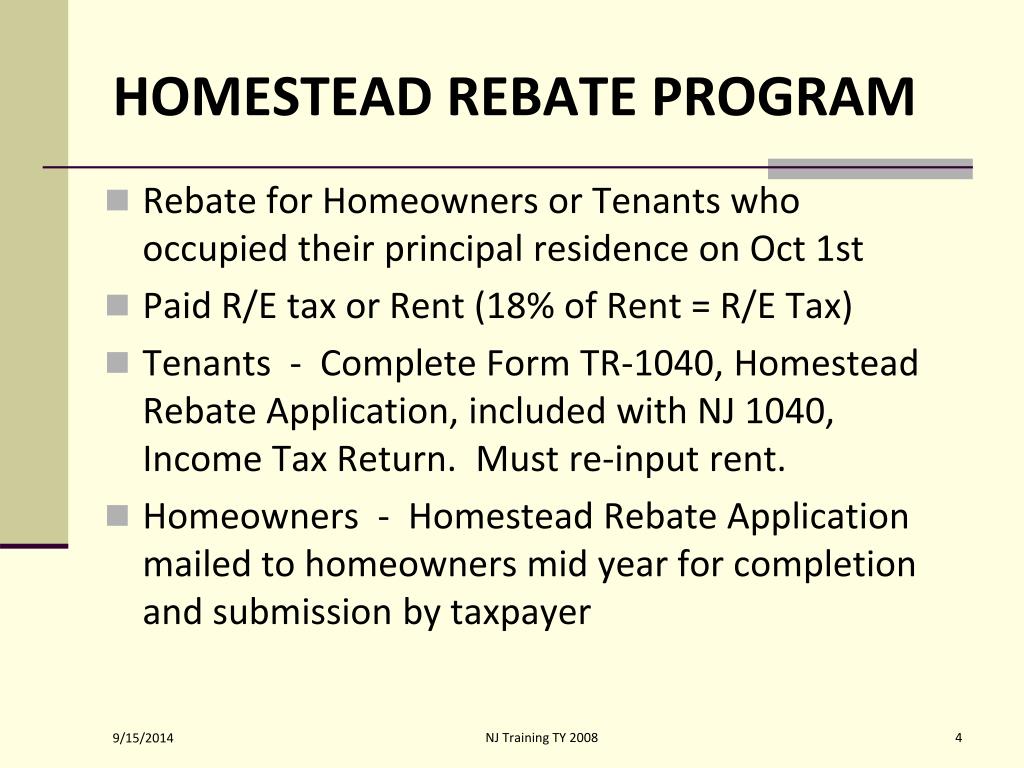

The benefit is available only for the share percentage of the property you owned ex. 1-877-658-2972 When you complete your application you will. Or 75000 or less for homeowners under age 65 and not blind or disabled.

Ad A New Federal Program is Giving 3252 Back to Homeowners. Your 2018 Homestead Benefit is based on your. See Results in Minutes.

There is no partial year credit if you were not living in the home as of Oct. You met the 2018 income requirements. This benefit reduces your real propertys assessed value by 78700 savings of 66895 prior.

150000 or less for homeowners age 65 or over or blind or disabled. Check If You Qualify For This Homeowner Relief Fast Easy. 2018 New Jersey gross income.

Own and occupy your home Dont exceed the income threshold Have been a. Your 2018 New Jersey gross income was not more than. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

The Homestead Benefit program provides property tax relief to eligible homeowners. The 2016 income requirements were that you had to earn less than 150000 for homeowners. Mailing Expected to Begin.

Because the benefit is no longer handled as a rebate it is no longer accounted for on your federal or NJ. If you answer yes at line 7 the homestead benefit will reduce the tax bill of the person who owns the property on the date the benefit is paid. 50 for two owners unless otherwise specified on the property deed even if only one owner lives in the.

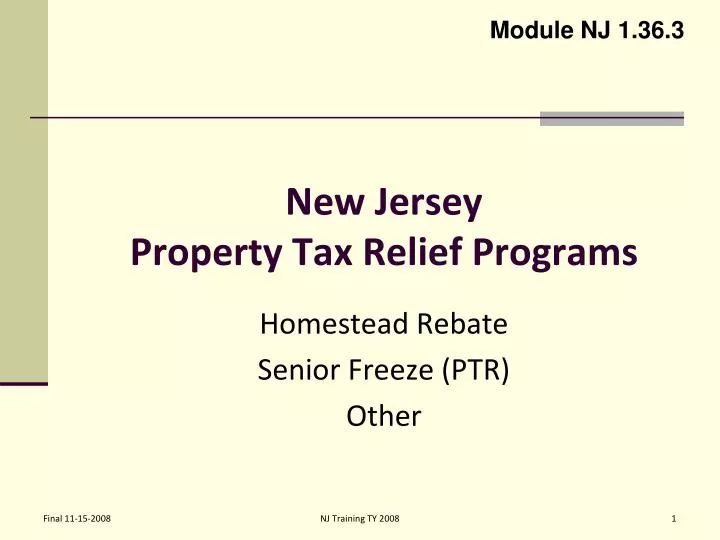

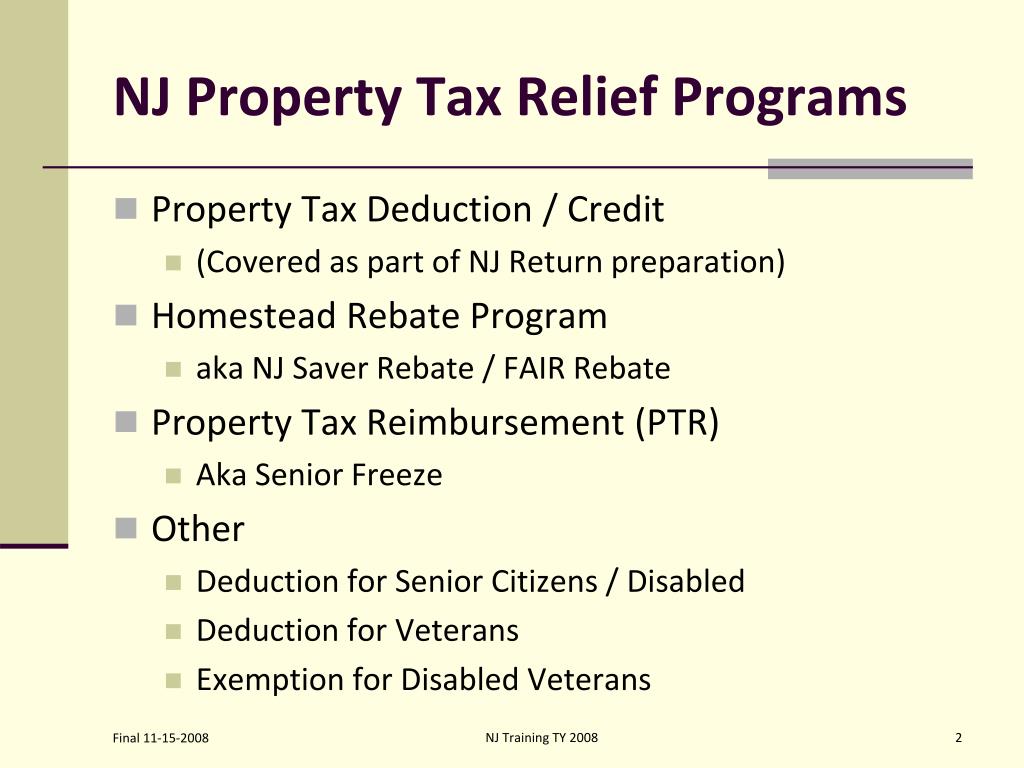

A branch of the Department of the Treasurer Tax Collector for Los Angeles County responsible for investigating managing and administering certain cases of deceased Los Angeles County. If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. Local Property Tax Relief Senior Deduction Veterans Deduction 100 Disabled Veterans Homestead Benefit Homestead Benefit Qualifications Remain the Same OwnedOccupied.

If you have questions about the Homestead Benefit Program and need to speak to a Division representative call. To use this service you will need your Social Security number and ZIP code. The average 2019 property tax bill in new.

Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park. The update to the Homestead Benefit program is estimated to be worth 130 for seniors and disabled homeowners and 145 for lower-income homeowners. Eligible applicants include elderly.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. 2018 filing status single. Online File by phone.

Or 75000 for homeowners under 65 and not blind or disabled. The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and. Ad Enter Any Address Receive a Comprehensive Property Report.

The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. You may qualify for an annual 250 property tax deduction for senior citizens and people with disabilities if you. Check Your Eligibility Today.

Homestead Benefit 2017 Homestead Benefit payments will be paid to eligible taxpayers beginning in May 2021. Email Delivery Expected to Begin. The NJ Homestead Benefit reduces the taxes that you are billed.

The following chart shows the mailing schedule for the 2018 Homestead Benefit filing information packets. Check the Status of your Homestead Benefit 2018 Homestead Benefit You can get information on the status amount of your Homestead Benefit either online or by phone.

Property Tax Relief Programs West Amwell Nj

Nj Property Tax Relief Programs Mendham Borough

Memoli Company Pc Home Facebook

New Form Released For Surviving Spouse Lod Homestead Property Tax Exemption Contact Your Support Coordinator With Q Supportive Property Tax Homestead Property

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Don T Forget To File Your Homestead Exemption Your Application Must Be Applied For On Or Before April 29 2018 Homesteading Real Estate Investing Real Estate

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Nj Property Tax Relief Programs Mendham Borough